A sideways look at economics

The use of cash as a medium of exchange is in long-term decline in most countries. Consumers have increasingly switched to electronic payments and online shopping, trends that have only accelerated during the COVID-19 pandemic — leading some to suggest that the virus may prove the final nail in the coffin for notes and coins. Sweden is often highlighted as a harbinger of the future, where even most banks no longer have cash and beggars accept electronic donations![1]

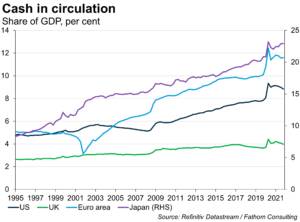

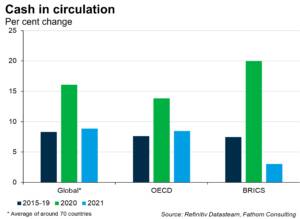

Interestingly, however, over recent decades the amount of cash in circulation as a share of GDP has not been falling but has increased quite sharply in a number of countries (first chart below). This is consistent with a decline in the velocity at which cash is circulating. The last couple of years have seen particularly large gains in the amount of cash in circulation — and the phenomenon has been a pretty general one, happening in both developed and emerging economies (second chart below). In 2020, the average increase in cash in circulation across the globe was around 16%, roughly double the prior five-year average. In the BRICS, the gain in currency in circulation was a massive 20% in 2020, almost triple the five-year average rise of 7.5%, although the average gain decelerated to just 3% in 2021.

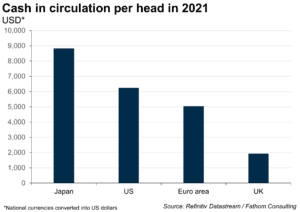

For those like me no longer accustomed to carrying any cash in their wallets, it will come as a big surprise to learn how much of the stuff is actually circulating per head in the major economies. In the UK it was around $1930 in 2021, in the euro area $5030 and in the US $6240, while in Japan it was around $8820 (the long period of zero interest rates and low and negative inflation in Japan has significantly reduced the opportunity costs of holding cash). Of course, this does not necessarily mean that every individual has a vast cash stash under the mattress: hoarding may be more prevalent in specific sections of the population. Cash is also extensively used as a medium of exchange in the underground economy; unsurprisingly, drug dealers prefer it to American Express! Moreover, estimates suggest that over half of the US greenbacks in circulation and around 30-50% of euros are held abroad.[2]

The huge upsurge in demand for cash over the last couple of years has been driven by the pandemic, one of the largest public health and macroeconomic shocks over the past century. This is normal: people typically do hoard large amounts of cash when there are financial panics or major geopolitical events. The fact that the vast bulk of the increase in cash in circulation was in the highest denomination notes lends further support to the view that hoarding was the key driver. The value of the US dollar notes in circulation is up by about 25% since the beginning of 2020: around 80% of the rise was accounted for by $100 bills. Some of the rise in demand for US dollars also reflects people hoarding it overseas.[3]

As ever, there are additional country-specific factors at play. It will come as no surprise that some of the largest gains in cash in circulation occurred in Argentina and Turkey. Worsening economic problems and fears about the banking system in both those countries were probably what drove citizens to hoard more cash, although surging inflation has meant it proved a terrible store of value. Chile, often seen as a Latin American success story, is a more surprising entrant on the leader board, but cash in circulation is up 70% since the end of 2019. This probably reflects rising political and economic uncertainty.

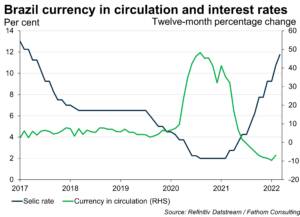

So where can we expect the demand for cash to go over the next few years? The ongoing shift to electronic payments should continue to reduce its use as a medium of exchange in the formal economy. Forecasting demand for hoarding is notoriously difficult, however, given it is often driven by major unexpected events. That said, there is some reason to think that the hoarders could be in retreat. Indeed, the allure of hoarding is likely to be reduced by rising interest rates, which increase the opportunity cost of holding cash. It is perhaps no surprise that cash in circulation slowed sharply in the BRICS in 2021, when the Brazilian and Russian central banks hiked interest rates aggressively. Nevertheless, cash will continue to be a key payment of choice in the underground economy because of its anonymity — and also, one suspects, because many drug dealers and gun-runners may not be able to stomach the volatility in the price of bitcoin!

[1] see Money Money Money – Fathom Consulting (fathom-consulting.com)

[2] For the US, see EconPapers: The Death of Cash? Not So Fast: Demand for U.S. Currency at Home and Abroad, 1990-2016 (repec.org), for the euro area, see The paradox of banknotes: Understanding the demand for cash beyond transactional use (europa.eu)

[3] For a detailed analysis of the surge in cash holdings during the pandemic, see Centre for Economic Policy Research (cepr.org)