A sideways look at economics

Last month, I had the pleasure of attending day three of the final Ashes test match at the Oval. The sun was out, the conversation was flowing and the cricket was good. The only problem was the price of the beer (or cooking lager, as some describe it) — at £7.60, the venue’s offering is no longer the kind of thing that you can pay for with the loose change in your pocket.

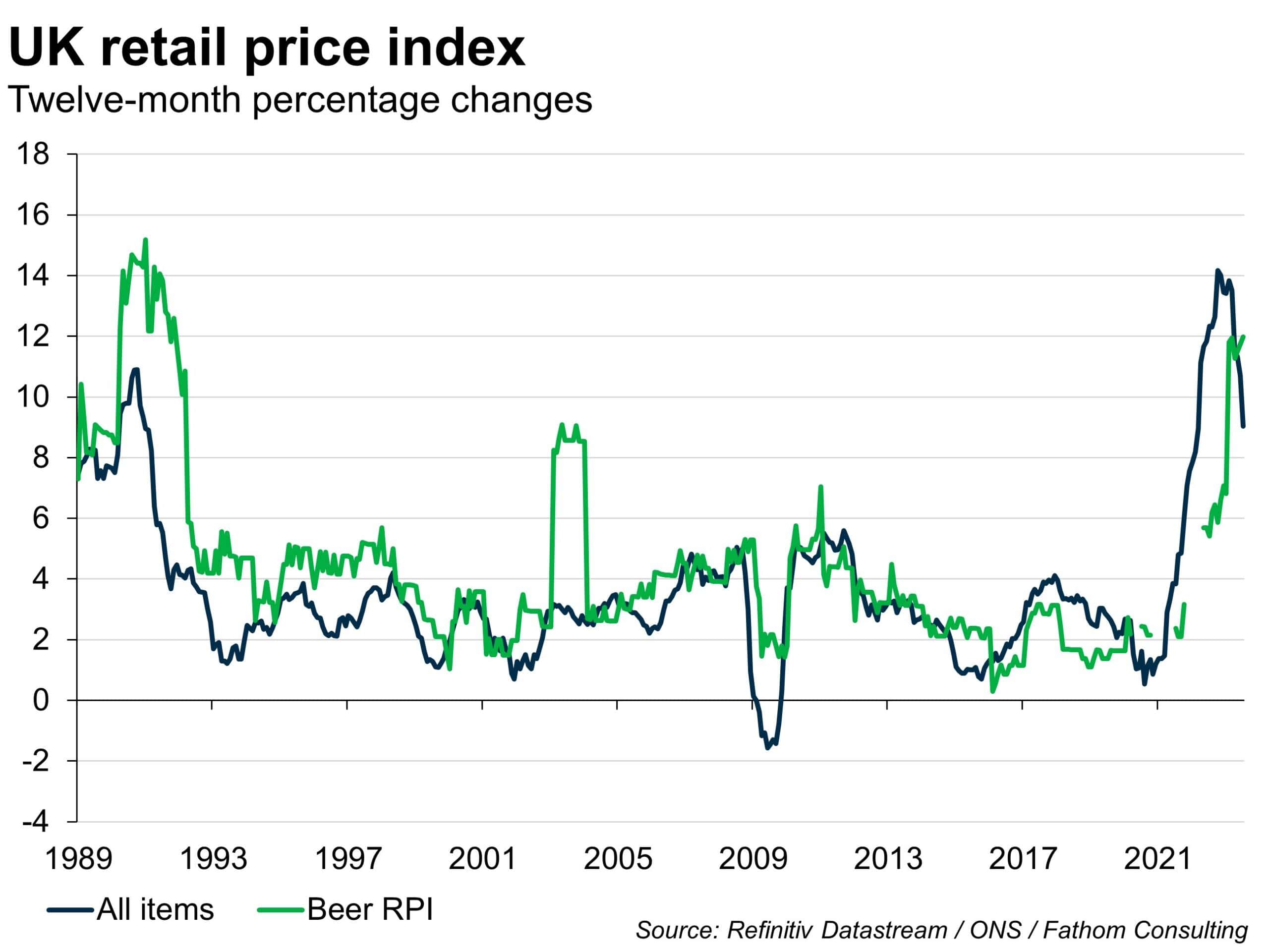

I’ve previously used this blog to explore whether both the demand for beer and the equity prices of its suppliers can be used as a predictor of GDP growth — in short, the answer is yes (and no). This week, I thought I’d have a look at the other side of things: inflation…

The Office for National provides pretty good data on beer here in the UK. Indeed, unlike for a number of items in the inflation basket, they actually include average price of draught lager, in addition to the index. Shockingly, those data show that the average price of beer reached an all-time high of £4.58 in July, an increase of 49 pence over the past twelve months! Of course, this is an average level across the UK, with some regions likely to pay significantly more than others. A survey in 2021 by Holidu found significant dispersion across the UK, with the average pint in London costing around 45% more than the equivalent in Inverness.

So, can beer prices tell us anything about the broader outlook for inflation? Given that the data are released by the ONS at the same time as the aggregate inflation numbers, we can’t use beer prices as a nowcasting variable. But could beer prices tell us anything about the expected future trajectory of inflation? The academic literature on inflation typically finds that consumers are more aware of changes in the prices of those goods and services they buy on a regular . And the more they notice these changes, the more likely they are to ask for higher wages. At a time where wages are rising by 8.7% year-on-year and beer prices are rising by 12% year-on-year, this certainly could be cause for concern.

A simple contemporaneous correlation between beer price increases and wage growth suggests that beer is no more informative in explaining rising wages than CPI, and actually performs slightly worse than RPI (which is good news, since both are now falling). However, if we look at the correlation between the changes in beer price hikes and the changes in wage growth, then it does outperform both the aggregate RPI and CPI, albeit with the caveat that the signal it does send is quite weak. Essentially, beer prices aren’t particularly good at telling you where wage growth currently is, but they might tell you something about where it could go next.

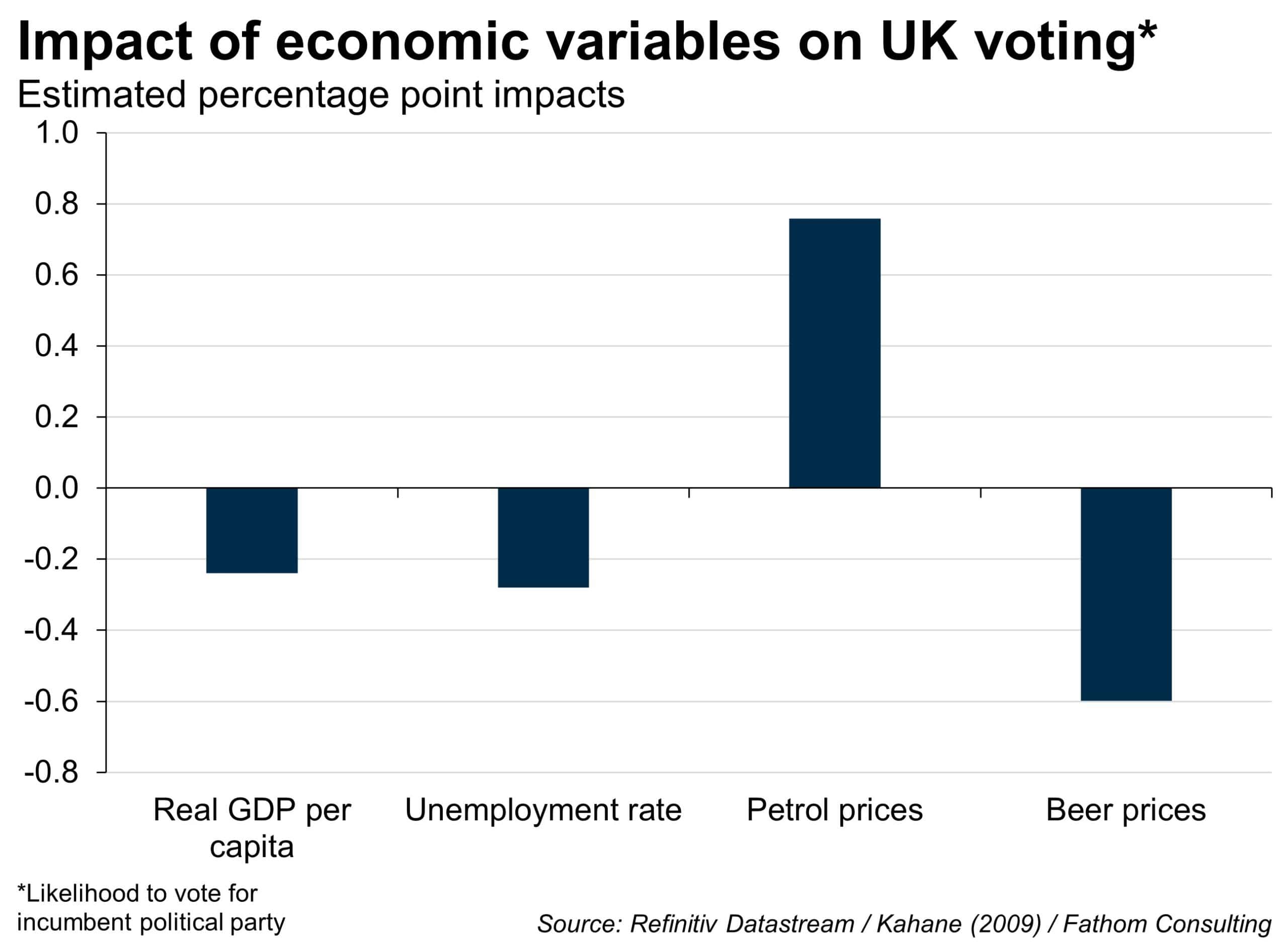

There’s always a cheer in the House of Commons when the chancellor announces a freeze on or, better still, a cut in duties on beer, normally describing it in terms of pennies on the price of a pint. That attests to the signalling importance of those easily recognised prices of frequently bought items. Of course, beer isn’t the only product which receives this kind of close scrutiny —fuel prices do too. In the context of the US, Kahane (2009) finds evidence that economic factors a year before an election do have measurable impacts on voting patterns during presidential elections. In particular, he found that:

A one percentage point increase in real GDP per capita growth boosts the incumbent party candidate’s (IPC) share of the popular vote by 0.9 percentage points

- A one percentage point increase in the unemployment rate reduces the IPC’s share by 0.7 percentage points

- A one percentage point increase in gasoline inflation reduces the IPC’s share by 0.05 percentage points

Plugging these numbers in for the UK actually provides a glimmer of hope for Rishi Sunak’s government, thanks to the decline in petrol prices over the past year. Of course, Kahane’s work doesn’t specifically apply to the UK. Moreover, it doesn’t include the affects of beer prices on voting patterns (which I personally think is a shame). If we assume that consumers are as sensitive to changes in beer prices as they are to changes in petrol prices (an admittedly controversial suggestion) then the polling boost from falling petrol prices would be completely erased.

Obviously, more work would be required to fully assess whether beer can be used as a good predictor of inflation and, even more work would be required if we are to assess the consequences for UK voting patterns. But one thing we can assess easily is the price of beer at Fathom’s local. Time for a fact-finding mission I think!

More by this author