A sideways look at economics

It’s Economics 1.01: the laws of demand and supply state that as prices increase, buyers will demand less of a good and sellers will seek to supply more of it. Together, these forces determine market prices. But what if I told you that you that many brands choose to intentionally under-price their goods — seemingly passing up the opportunity to maximise their profits in the process?

Imagine this. You’ve just paid a visit to your favourite jeweller and bought a sparkling, new, luxury watch to celebrate a significant life event: maybe an anniversary, or your biggest bonus in years. And on wearing it out for the first time to a celebration dinner at a swanky restaurant in town, you’re approached by a wealthy punter who is willing to offer you double the price of your wristwatch to, quite literally, take it off your hands! You politely decline, but your interest is piqued. Later that week when visiting an auction house, you observe that the same model is welcoming bids starting at three times its face value.

Well, in truth, there’s nothing truly extraordinary about this watch: it tells the time and looks very fancy on your wrist like so many others do! But there is insatiable demand for it. With every passing month you see it selling for higher and higher prices on second-hand markets, and the demand never seems to relent. What’s going on?

In short, you’ve been lucky (or wise) enough to tap into hype culture. The price you paid to the retailer for the exclusive model on your wrist is way below the clearing price that the second-hand market is willing to support.

This unusual pricing model is most often seen in relation to luxury and fashion brands. Brand marketing departments work long hours to ensure that a particular model gains an aura of ultra-desirability, thus increasing the cachet of the brand’s entire range. Often with the active help of influencers or fashion gurus, a particular model suddenly becomes the essential thing to own. These goods are generally sought after by affluent consumers who place a premium on the ownership of a good above that of the utility they derive from it. The US economist Thorstein Veblen coined the term “conspicuous consumption” to describe this — consumption for the purpose of being seen.

In recent years this phenomenon has drawn closer to mainstream culture, with major retail brands, such as Nike and Adidas, collaborating with famous icons, artists and designers (such as Kanye West, Beyonce, and Prada) to sell goods below market prices, as a form of marketing and as a brand-building exercise. Streetwear brands have become ever more adept at manipulating hype culture where consumers, known as hype beasts, seek to bag the latest exclusive drops and newest releases.

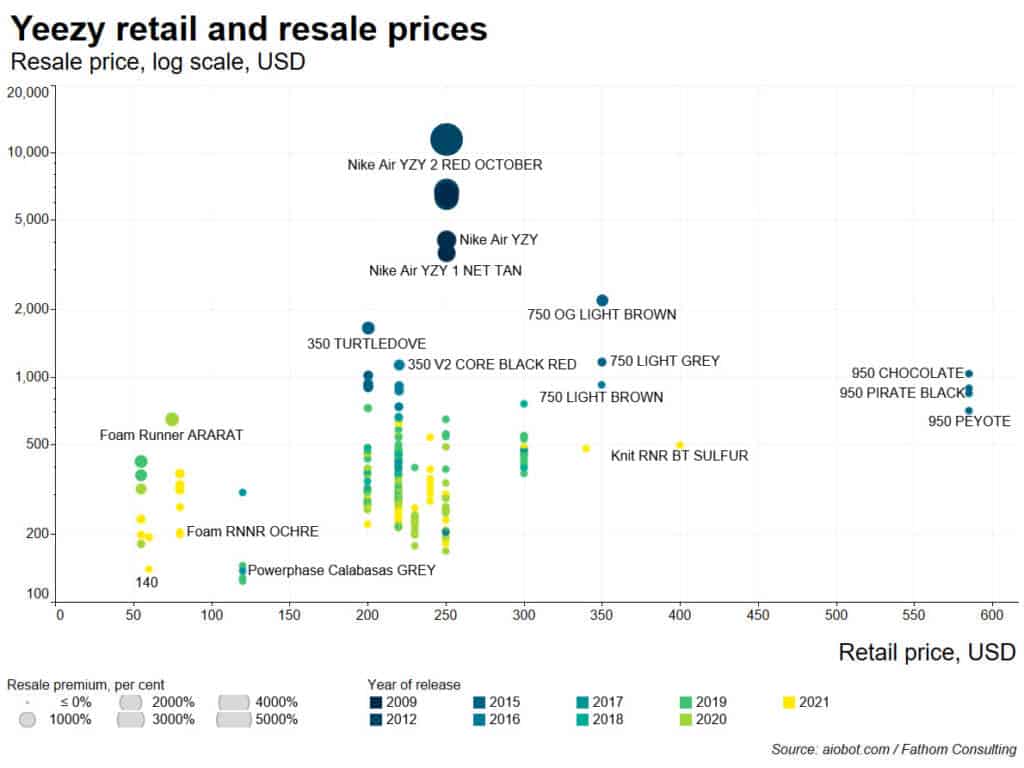

A point to reiterate here is that the retailers intentionally fix the quantity they supply, and do not raise production to meet higher demand, and thus meet the profit-maximising price. This is the crux of their strategy. It is by the very act of limiting supply that these brands are able to generate ‘hype’ around their products. Retail prices remain (relatively) affordable, yet second-hand prices may often reach many multiples higher. For example, a website, aiobot.com, tracked retail and second-hand prices of Yeezys (Kanye West’s fashion brand) and found a pair of $250 RRP, 2012, Nike Air YZY 2 RED OCTOBER trainers to be on re-sale for $11,495 in 2021. A pair of trainers offering a 53% annualised return – not too shabby for the purchaser!

The logical question at this juncture is: “Why would a brand not simply profit-maximise in this circumstance?” It’s clear that there is a significant consumer surplus which could be captured by the retailer here.

Their strategy is two-fold. First, as mentioned above, hype culture seeks to market a brand’s desirability. The exclusiveness of a handful of products raises the brand’s overall image, and encourages the wider market to purchase its other products (as, by association, they too are deemed to be fashionable and exclusive items to own). In effect, there is some other social maximisation the firm pursues here. The profit comes in the form of reputation that generates repeat business.

Second, firms that pursue this strategy often will only sell these goods to select groups of customers: specifically, customers that have a long purchase history with the brand. Over time, brands extract profit from repeat customers who have purchased multiple goods from the retailer. The strategy is to encourage consumers with long purchase histories to buy into the brand’s other goods. By encouraging this, the retailer can effectively equate the producer surplus from selling multiple goods to the consumer surplus that a consumer receives from purchasing a single good at retail price.

But can this last forever? Conspicuous consumption is only ever sustained by what is perceived to be ‘premium’ or ‘exclusive’. Ultimately these are fickle things. A similar tactic to hype culture is used by the creators of some cryptocurrencies, where the supply of ‘coins’ is strictly limited and the adoption by influencers leads to a market pile in. But as recent purchasers of Bitcoin have discovered, what goes up can very quickly come down.

Yeezy trainers: picture by Amanda Vick on Unsplash

More by this author:

Your dream home

Escaping the tentacles of debt

Most charts suck

The green industrial revolution