A sideways look at economics

The third Monday in January is officially considered to be the most depressing day of the year, known as “Blue Monday”, when memories of Christmas are fading, temperatures are low, days are dark, and the next bank holiday cannot arrive soon enough. This year’s Blue Monday fell on the Monday that has just passed. The definition of Blue Monday was established in 2004 at the request of a UK-based travel booking company, and is allegedly based on a mathematical formula, although details of this are scant. Its scientific existence is thus highly debatable, and the true reason for the birth of Blue Monday is probably to be found in this week’s tsunami of travel booking ads and travel programmes on British television: it is a marketing trick to boost holiday bookings. Although the battle for the reputation of the third Monday in January seems lost, the war for the title of the “bluest” weekday is not over. I, for one, am determined to submit evidence to establish once and for all whether Monday deserves its dismal name.

It is becoming a Fathom tradition to discuss in this column seasonal topics that make us feel better (Christmas) or mixed (heatwave) through the lens of equity market reactions. The markets are not in vitro life, of course, but are full of such contradistinctions and sentiment that they make an ideal laboratory of conditional human behaviours. Being a proponent of that approach, I set out to examine whether the equity markets suffer Monday “blues”.

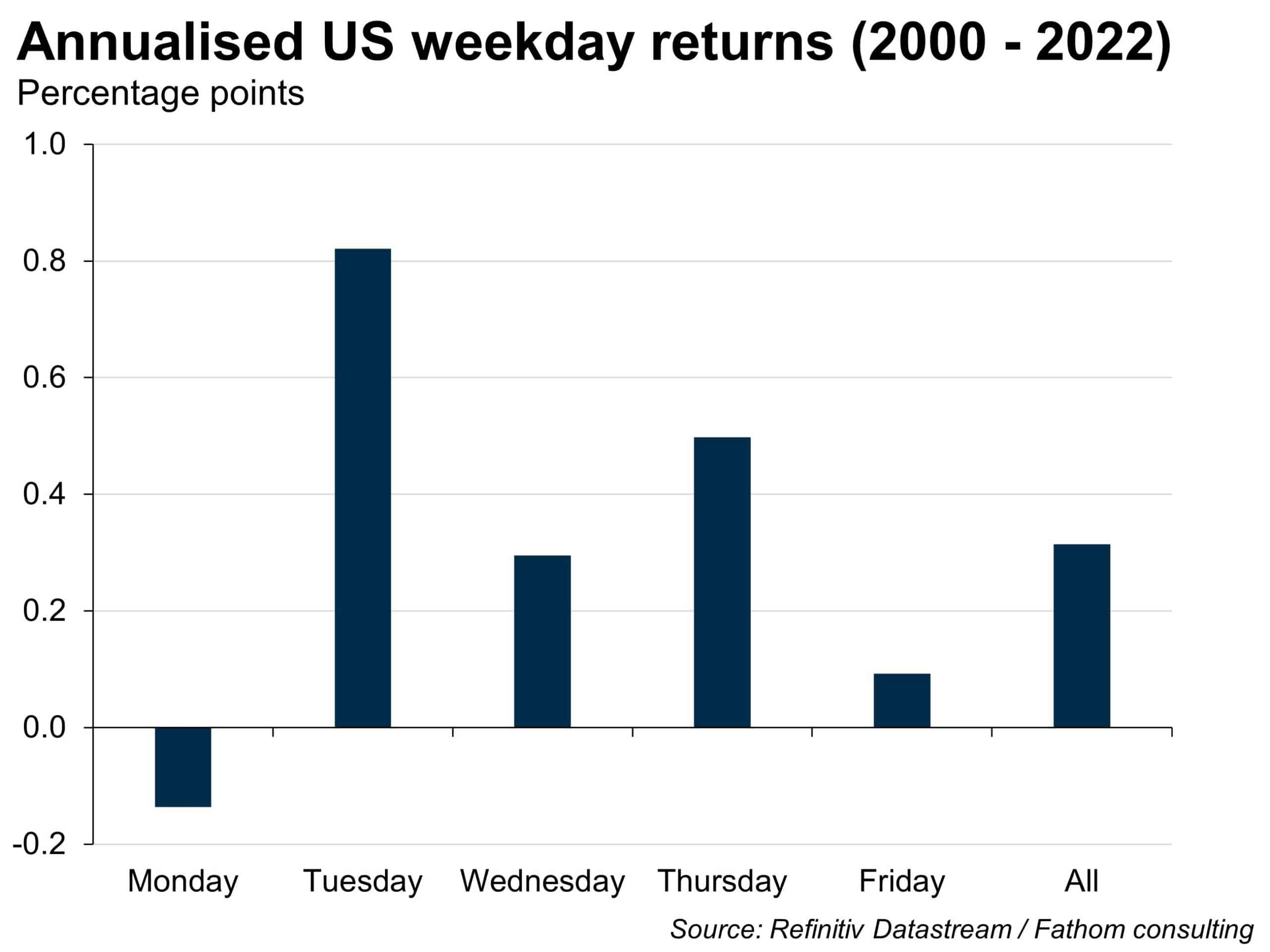

Historically in US markets, the largest of them all, there have been differences in the daily mean returns across the days of the week. A common finding is low Monday returns, but evidence was last reported in 2004.[1] A daily sample spanning 2 January 2000 to 14 January 2022 confirms that Monday is the only weekday with negative average returns (-0.14%).

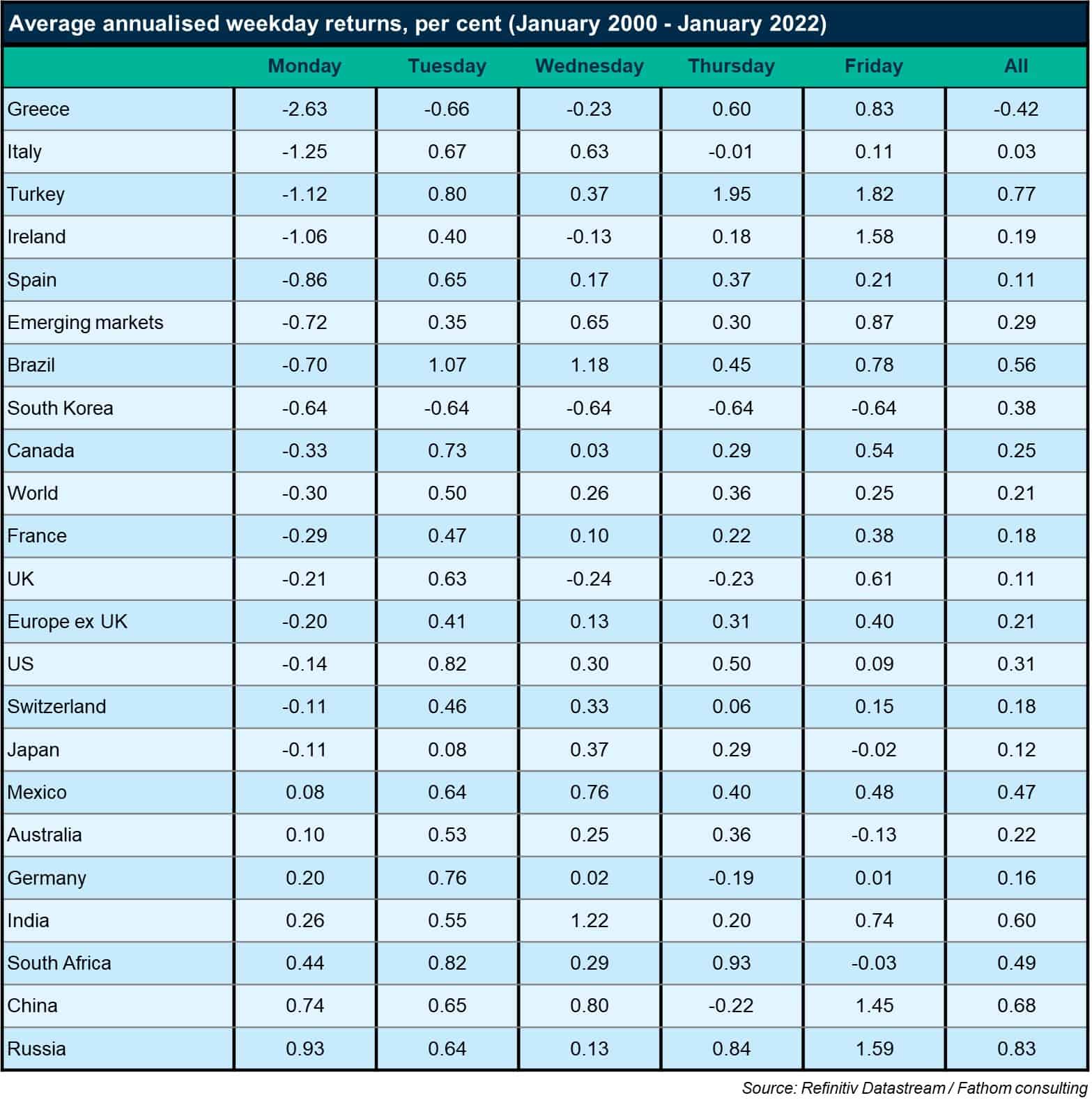

Could this be because Americans are genuinely grumpier on Mondays? To find out, an international comparison of the same time span is warranted. The next table reports the average weekday returns as well as the all-days averages for 23 countries and country groups.

Evidently, the Monday blues are not unique to the US but are present in most markets. Markets in Greece (-2.63%), Italy (-1.25%), Turkey (-1.12%), Ireland (-1.06%), and Spain (-0.86%) top the list for the worst cases of Monday blues. Apart from their vivid temperaments, these countries also share an unusually marked propensity for political decisions or revelations to emerge over the weekend that are then quantified on the first trading weekday. The UK falls somewhere in the middle of the list, at -0.21%, but exhibits a more negative Monday return than the US; maybe this should not be a surprise for the country that invented Blue Monday. I was surprised to see that Germany does not suffer from the Monday blues, given that all other comparable countries do. Perhaps this is yet another testament to Germany’s efficiency and measured responses.

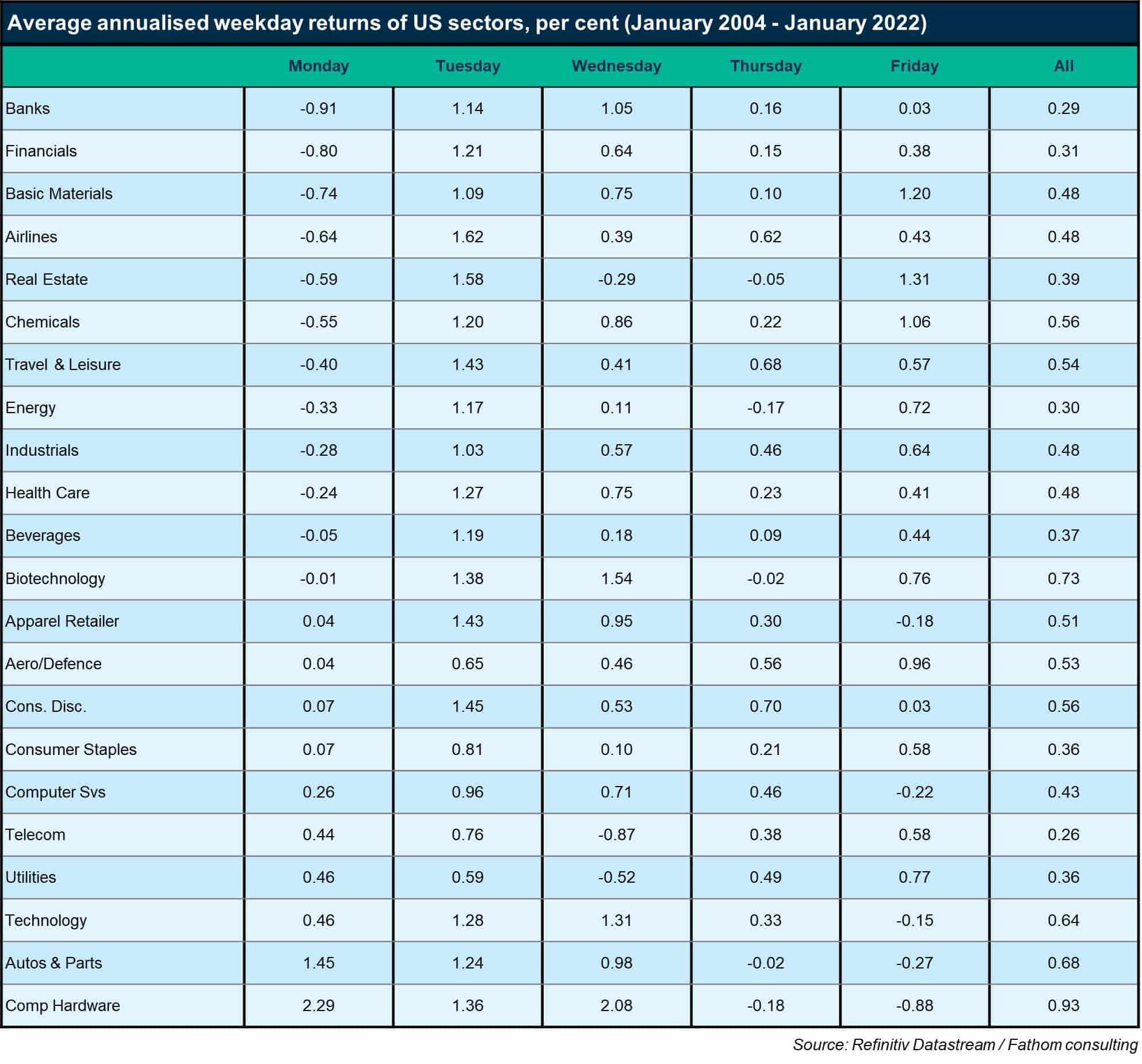

Further investigation reveals that Monday blues do not stay on the aggregate level but infiltrate industry sectors, with unpopular financials topping the list (banks -0.91% and financials -0.80% Monday returns).

There’s probably no single reason why Monday blues hit the markets, but some possible explanations come to mind.[2] Companies are prone to release bad news on Friday nights, when fewer people are attentive.[3] Monday is the first day that investors can react. And when companies collapse, they often do it late on Sunday or early on Monday, after spending a final weekend trying to stay afloat — see, for example, the Lehman Brothers bank, which fell on Monday 15 September 2008.

But still the evidence may be circumstantial, and driven by a few large, irrational events such as the “Black Monday” of 1987. What we need for a more conclusive finding is to show that the whims of traders placing millions of individual buy and sell orders are conditional on trading on a Monday — in other words, to show that Monday blues are a source of non-diversifiable risk because they have been “institutionalised” in the equity pricing. After all, if the overall market believes in something, that something, even if irrational, becomes non-diversifiable.

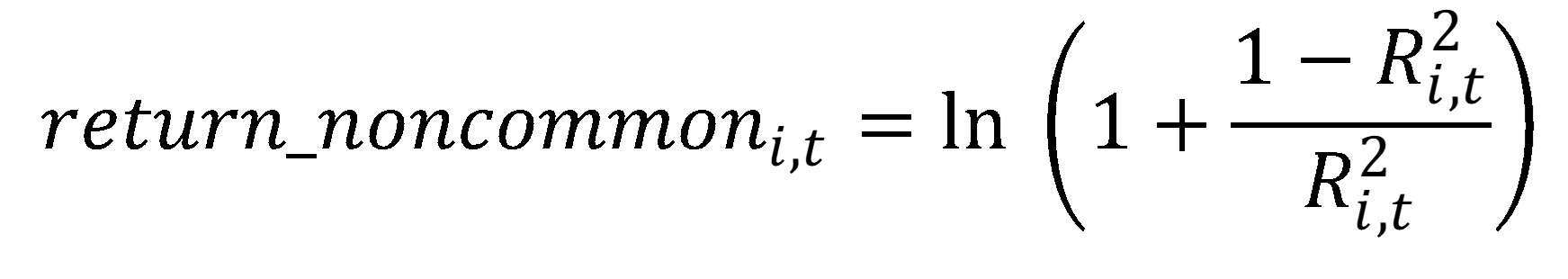

To examine that proposition (and because my inner geek is not content with averages), I employed the return non-commonality[4] concept: the degree to which returns are determined by idiosyncratic factors. The lower the non-commonality, the higher the presence of non-diversifiable equity risk. For each industry i and day t over a window of 250 calendar days, I regressed the excess daily returns (Returne) on the Fama-French four risk factors: the excess return of the market portfolio (MKT), the small-minus-big factor (SMB), the high-minus-low factor (HML), and the return momentum factor (MOM).[5], [6]

![]()

These rolling regressions were fitted twice; first, with the Monday data of the 250-day window and, second, with all non-Monday window data. I then used the goodness-of-fit statistics (R2) for Mondays and non-Mondays to estimate their respective return non-commonalities as:

The next, and final, table tabulates the industry-specific averages of the Monday and non-Monday return non-commonalities with their differences and t-statistics, examining the null hypothesis for the mean differences.

Monday industry-specific returns do exhibit lower non-commonality than all other days, and that pattern is statistically significant with at least 95% confidence. This finding suggests that for all industries the proportion of non-diversifiable risk is larger on Mondays than other weekdays. That Monday-centric, higher non-diversifiable risk is consistent with the view that the Monday blues among investors become a source of non-diversifiable risk to other investors, and are so priced in equilibrium. In other words, investors set prices on Mondays relative to other days such that they extract a premium for having to bear an additional source of risk on Mondays compared to other days.

There you have it: Monday is officially the bluest weekday. But a problem can be seen as opportunity; and, helpfully, the Monday problem occurs in a timely way, being the first working day. So, for those with an eye to making a good return, perhaps in the equity markets, Monday is the weekday on which one can identify and grasp opportunities that could brighten up the rest of the week.

[1]Leonard Zacks’s edited “The handbook of equity market anomalies: translating market inefficiencies into effective investment strategies” offers a review of the day-of-the-week effects in Chapter 9.

[2]Leonard Zacks’s edited book offers sources to that end in Chapter 3.

[3]See DellaVigna and Pollet (2009) for more details.

[4]The return non-commonality was introduced in empirical finance by Piotroski and Roulstone (2004).

[5]The Fama-French factors are made available by Professor French here.

[6]Excess returns are estimated by subtracted the one-month T-bill rate, also available in Professor French’s webpage.