A sideways look at economics

A cartoon in the FT over the Christmas period featured the phrase “we’ve opened all the presents, eaten all the food and argued about Brexit — now what?” With great foresight, and keen to avoid the latter, my brother-in-law tacked a sign to the lounge door, pointing, as each family member made their way in, to the words “This is a Brexit-free zone! Non-compliance will result in a forfeit”. Lacking much new to say, and faced with the threat of festive embarrassment, appetite to transgress was low, and an Article 50-free Christmas was had by all. But while Brexit wasn’t allowed to feature in Christmas day discussion, a few of the topics covered by our weekly blog, Thank Fathom it’s Friday, did crop up. With that in mind, this week’s TFiF revisits some of our most popular posts of recent years.

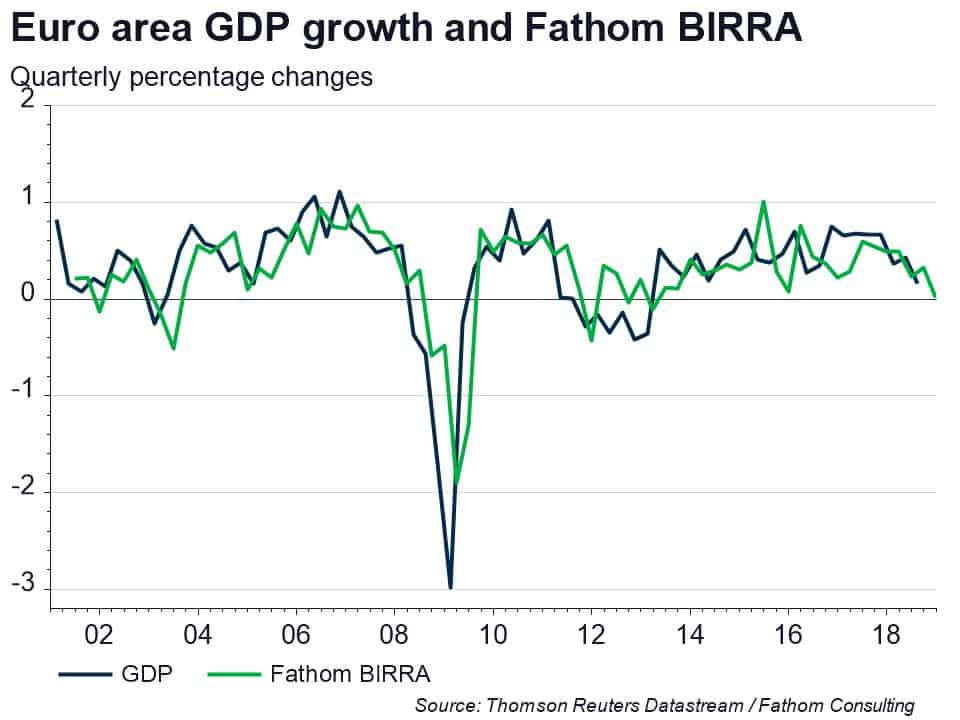

With heads still sore from the New Year festivities, we kick off by revisiting our blog, ‘Is beer really recession-proof?’. In August, Andrew Harris demonstrated that a cheeky pint is both enjoyable and of economic relevance, in so far as beer turns out to be a good predictor of economic growth! Using the equity prices of European beer producers to construct the Beer IndicatoR of Real Activity (BIRRA), he created a proxy for euro area GDP growth. This worked well: the measure pointed to weaker economic growth, as was observed. Things have since got a bit bitter, and our measure looks to have lost its ‘head’ entirely, pointing to a flatlining of GDP in the fourth quarter.

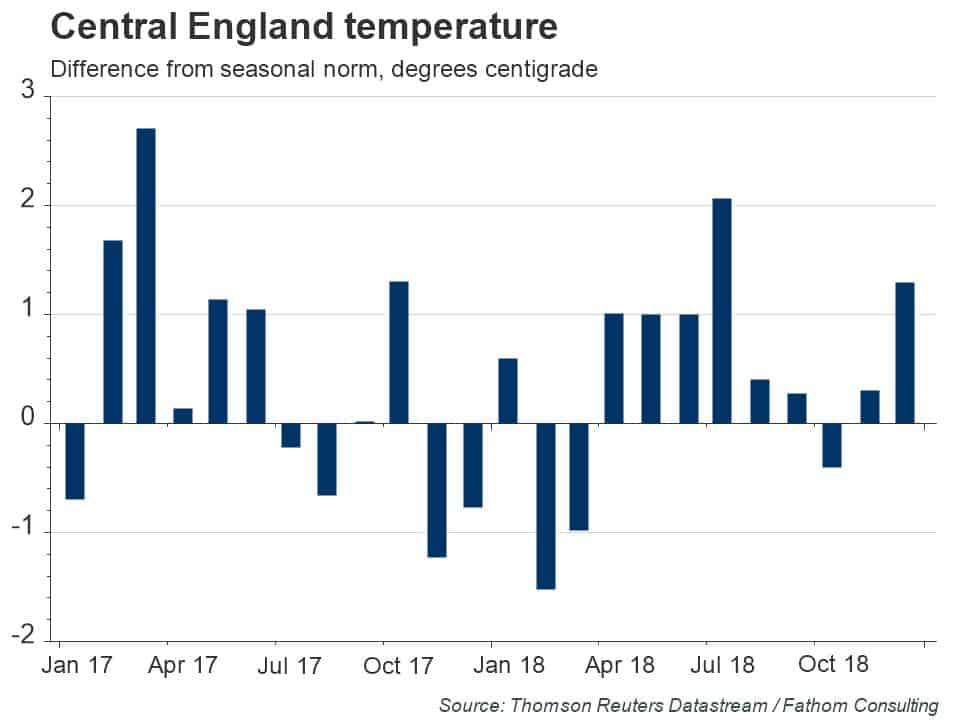

In true British fashion, we now turn to the weather. According to research, a stifling 94% of Brits will have talked about the weather in the past six hours alone, far more than elsewhere, rendering it a peculiarly British obsession. Recognising that weather is central to the British way of life, in a blog post in September Andrew Brigden asked whether the weather affects the British psyche enough to impact the official growth statistics? The answer: yes, it does! Specifically, he found that, when the weather is just one degree warmer than usual, the level of retail sales rises by 0.1%. This may seem small — but it’s statistically significant, even at the 1% level. What this means is that we should be able to be confident that, when the weather is warmer than usual for the time of year, we spend more in the shops. The warmer-than-usual weather this Christmas should have supported the spirit of giving, making a tough retail climate slightly more palatable for UK outlets. The proof will be in the pudding — December’s retail sales data will be released later this month.

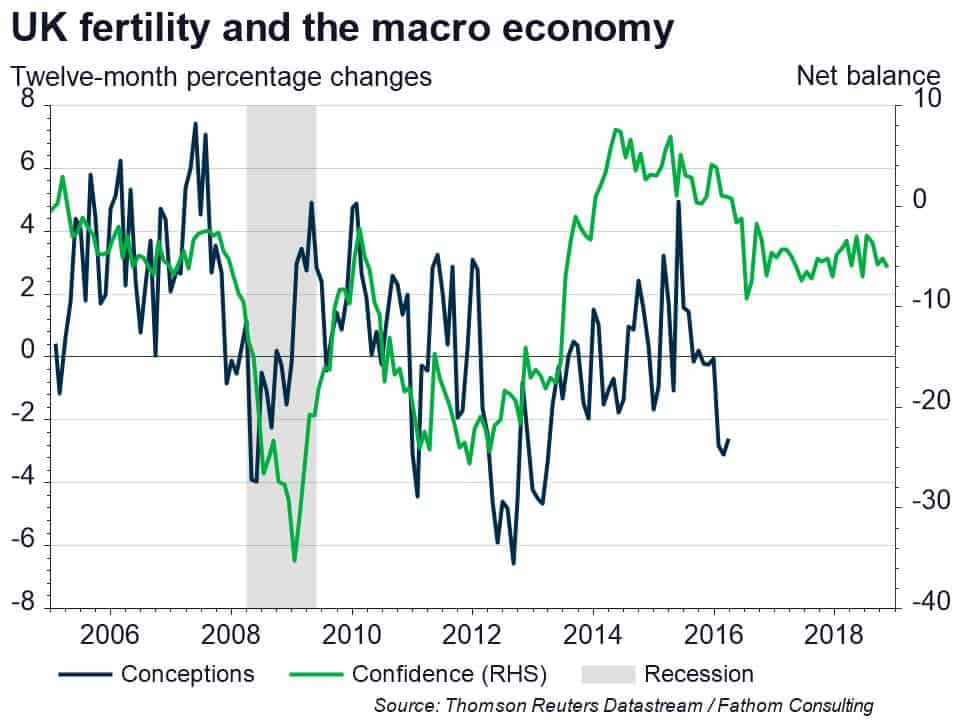

In a post in March, Andrew Brigden also considered how climates affect our lives, but this time the focus was on the relationship between the economic climate and the reproductive rate, asking if fertility could provide a new early warning indicator? The answer: maybe. Our chart compares the rate of growth of conceptions with consumer confidence. It seems that the former leads the latter by around two months. Notably, the twelve-month rate of change of the number of conceptions peaked at just over 7% in May 2007. By November of that year, this same figure had turned negative. The UK economy didn’t enter recession until the second quarter of 2008.

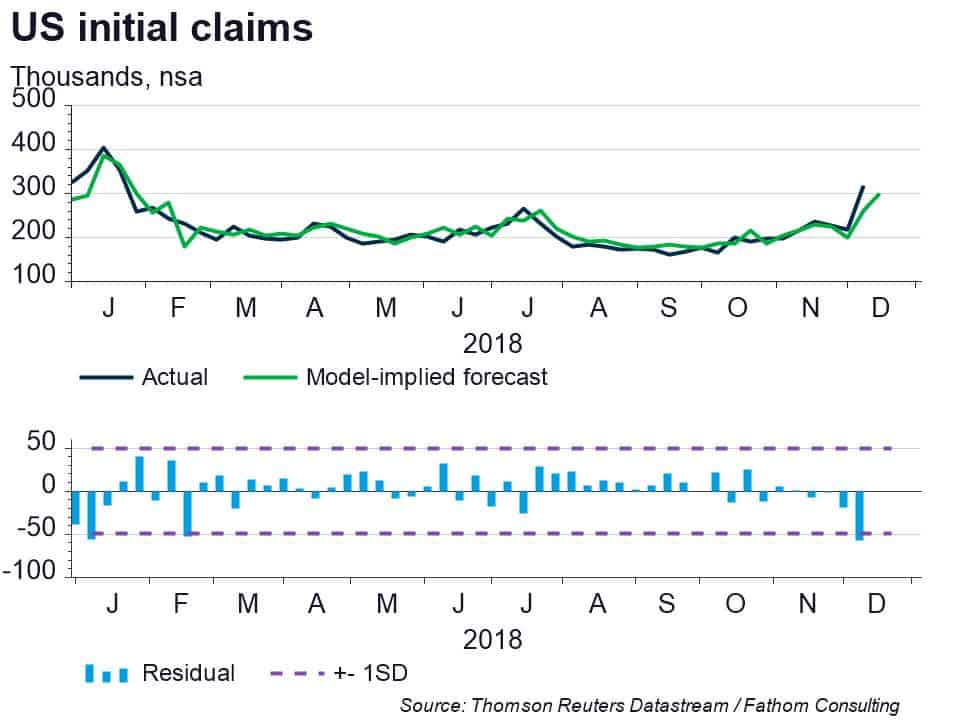

Fascinating though this finding is, with the same relationship holding for the US, as a forecasting tool, its usefulness is limited. Indeed, the ONS only publishes monthly birth statistics once each year, and then with a considerable lag. As the chart highlights, much of 2016 and all of 2017 data are yet to be published. An alternative tool, and one that we put to the test in relation to the US in a blog post in January, is the use of Big Data to help improve economic forecasts. Using a database of online searches from Google, Andrew Harris built a simple model to forecast initial jobless claims in the US. It transpired that the inclusion of search terms such as “job” and “unemployment” significantly improved the modelling performance.

How well has that model performed over the course of the year? Since it was published in January, and as highlighted by the chart below, it has functioned impressively, providing an accurate and timely forecast with few large errors. What’s more, the model’s performance (as measured by the adjusted r squared) has actually improved over the course of the year, all in all demonstrating the huge potential of Big Data.

Fathom’s US economist, Brian Davidson, focused on the small data — he kept track of the drink-making habits of his colleagues for seven weeks in the autumn of 2017. He found that the drink-making responsibilities were not evenly shared, with several members failing to pull their weight. The result of him sharing this information with the world? Watch this space – he’ll be posting the follow-up shortly.

On that slightly parched note, we hope you enjoy reading our weekly TFiFs as much as we enjoy writing them. From all of us at Fathom, we wish you a very happy and prosperous New Year.