A sideways look at economics

Growing up in the North-West of England has given me a long-held interest in developments in the manufacturing industry. Lancashire used to be the global leader in the production of cotton in the nineteenth century, accounting for a third of global output.[1] Apparently its damp climate, was ideally suited to this as it made the cotton fibres less likely to break during spinning. Some of the old mills remain as museums, a reminder of the glory days of old.

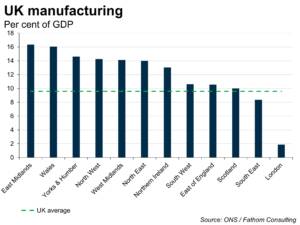

Even today, manufacturing is important for the economy of the North-West. It currently accounts for over 14% of Gross Value Added, around five percentage points above the national average of just under 10%, and 2% in London. Back at the turn of the millennium, its share was 21% in the North-West and 15% nationally. The North-West accounts for around a quarter of national production in key industries such as Pharmaceuticals and Aerospace, and similarly for the ‘Manufacture of Textiles’, although the latter is clearly a shadow of its former self.

The sharp decline in manufacturing’s share of GDP (and employment) in many Western economies has received significant attention, not least given the political fallout in the US from the offshoring of jobs to China. The debate around the importance of manufacturing is polarised between those who dream of a return to pre-globalisation days — when manufacturing made up a far greater share of the economy — and those who argue that we need to accept its increasing irrelevance.

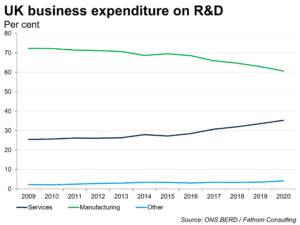

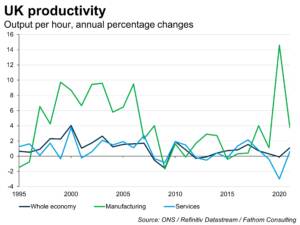

I wouldn’t put myself in either camp, but tend to think manufacturing’s importance may have been downplayed somewhat over recent decades in countries such as the UK. Its GDP share is still quite high in a number of regions and the sector’s economic footprint is larger than its share of national GDP would suggest.[2] It accounts for over 50% of exports, and over the past ten years has consistently accounted for over 60% of private sector R&D. Moreover, productivity growth has averaged around 4% in manufacturing since the turn of the century, compared with just 1% in the whole economy.[3] Bailey and Rajic (2020) also highlight that, when sectors dependent on manufacturing are taken into account, it accounts for 15 to 22 per cent of the economy and 18 to 27 per cent of employment.[4]

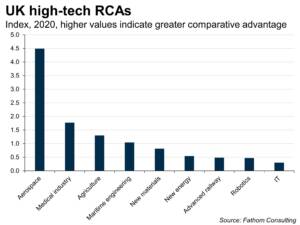

Looking to the future, automation[5] and the trend towards onshoring could potentially provide some opportunities for UK manufacturing, as could rising defence spending domestically and across much of the globe. Who knows, the collapse in sterling may finally provide a kicker too! There are some major risks lurking though, not least from China. A sharp structural slowing of growth could reduce demand for UK manufactures. Perhaps more importantly, Xi’s Made in China 2025 plan could mean that UK manufacturers face major new competition in areas such as aerospace and car manufacturing. The UK currently has a large Revealed Comparative Advantage in the former.

Unfortunately, I don’t see a ‘March of the Makers’ anytime soon, to use the phrase coined by George Osborne in 2011, but hopefully with supportive policies the sector can at least hold its ground. Indeed, getting manufacturers to step up their R&D spending could help the UK raise its low R&D spending share. Anyway, thinking of the more immediate future, writing this blog has rekindled my interest in the cotton industry and I’m intending to visit some of the museums when I go home to my parents for Christmas. I suspect I will notice the damper climate, although it may just be that I have become a bit of a ‘southern softy’.

More by this author:

Tracking cash for signs of a China banking panic

Will UK productivity ever improve?

[2] See Manufacturing matters for the UK economy — more than people commonly think | LSE Business Review.

[3] Productivity has been slower since the Great Financial Crisis. From 2010, output per hour has increased by 2.7% in manufacturing and 0.7% in the whole economy.

[4] For example, many service sector activities that were previously done in-house by manufacturers were outsourced to service sector firms, and now count as service sector output e.g., catering, delivery, design – see Inside the Black Box of Manufacturing: Conceptualising and Counting Manufacturing in the Economy

[5] Of course, this is likely to further reduce manufacturing employment.