A sideways look at economics

“We have two classes of forecasters: those who don’t know . . . and those who don’t know they don’t know.” John Kenneth Galbraith

My colleagues and I have held a series of meetings with clients over the past few weeks to present and discuss our latest assessment of the global macroeconomic and financial market outlook. Despite some positive news on growth in the third quarter, particularly in the euro area, our central message has remained largely unchanged since September: most major economies are facing recession. We are 90% confident that both the UK and the euro area are already there. The US is almost certainly not there yet, although we see a 70% chance that it will be early next year. For us, the historical precedent is compelling. Consumer confidence in most major economies has fallen to levels from which recession has never been avoided. And while both the US and the UK have once managed to bring inflation down from today’s levels without triggering a recession, that was as long ago as 1952.

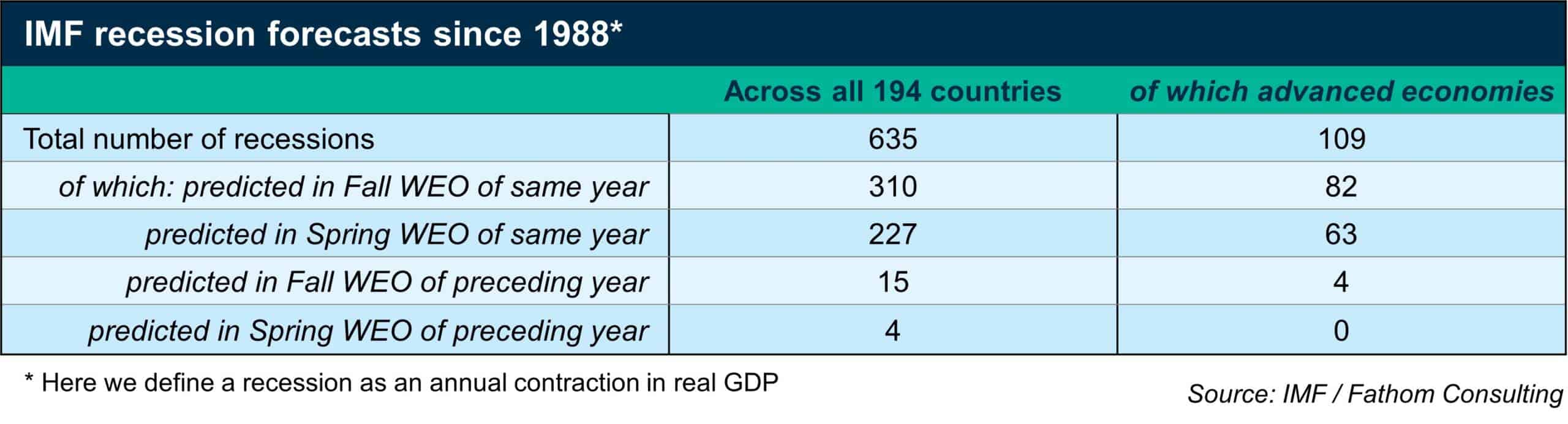

We are, of course, always transparent. As we relay the above information, we add an important caveat: economists are not very good at predicting recessions (and that is something of an understatement). I first drew attention to this difficulty in a blog post almost four years ago — ‘The economist who cried wolf’ — in which I analysed the IMF’s forecasting track record. Over the period from 1988 to 2018, I found there had been 469 recessions across the 194 countries for which the organisation provided forecasts.

How many of these recessions do you think the IMF had predicted in the preceding year? Half, maybe? Perhaps just a quarter? No. They had predicted precisely 13 of the 469, less than 3%. Worse than that, perhaps, they had predicted 21 recessions that never occurred.[1] For the purposes of this blog, I have extended my analysis to cover a further three years. The results are summarised in the table below. Over the period from 1988 to 2021, the total number of recessions has risen from 469 to 635. But the number predicted in the preceding year has changed hardly at all, rising from 13 to 15, or just above 2%. The number of false positives has risen from 21 to 23. It is perhaps a little unfair, in the circumstances, to blame the IMF forecasters for failing to predict, at the time of the October 2019 World Economic Outlook, the 160 recessions that took place worldwide in 2020. Fathom did though — well, some of them.[2]

What is unusual at the present time is the degree of confidence with which economists, normally unable to predict recessions, expect one to occur within the next year. Since the late 1960s, the Philly Fed has published a quarterly Survey of Professional Forecasters (SPF). Among other things, respondents are asked to assign probabilities to the US suffering an economic contraction in the present quarter, and then one, two, three and four quarters ahead. In the latest survey, published last month, the mean probability forecasters attached to the US suffering a contraction four quarters ahead, so in 2023 Q4, was 43.5%. The mean probability at that horizon has never been higher, by some margin (the previous peak for the four quarters ahead probability was 34.1%, and that was in the survey before).

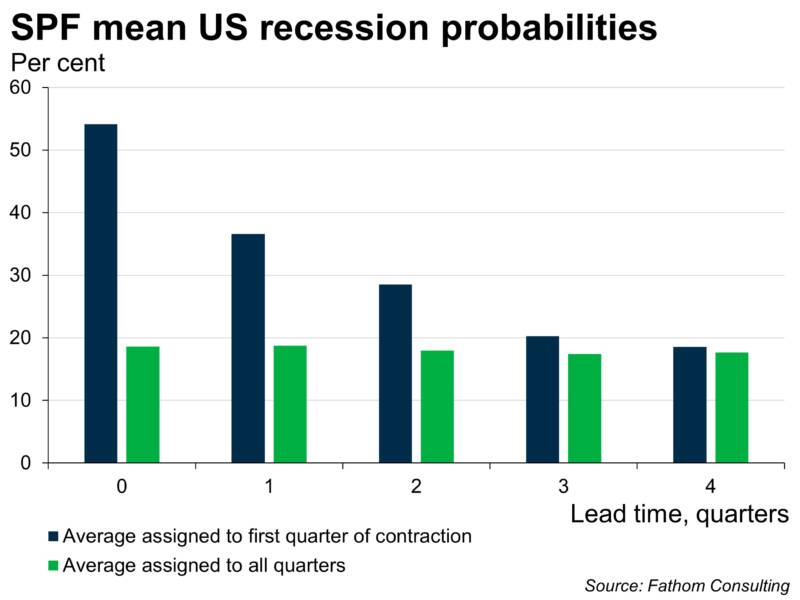

How sensible are the probabilities assigned in the SPF? Perhaps the first point to note is that they are typically a bit high. Across all five horizons, and looking across all surveys since the late 1960s, the reported mean probability of an economic contraction has been 18%, when in truth economic contractions have occurred just 14% of the time. So forecasters are prone to exaggerate the risks a little bit.

Nevertheless, as our chart shows, there is useful information in the survey. The blue bars show the mean probabilities of contraction that have been assigned to those quarters that turned out to be the first quarter of contraction, in a recession identified by the NBER. The green bars show the mean probabilities of contraction that have been assigned to all quarters, whether or not they turned out to be the start of a downturn. When the blue bar is significantly higher than the green bar, there is useful information in the survey. My interpretation of this chart is that forecasters are pretty good at spotting trouble brewing up to two quarters ahead. Thereafter, success is limited.

What do we conclude? The mean probability of the US being in recession four quarters from now is judged, by economists, to be higher than it has ever been in the past 50 years, by some margin. Forecasters have not had much success at predicting recessions this far ahead in the past. But equally, they often do not try – the interquartile range of the mean probability assigned to the quarter four quarters ahead runs from 13.1% to 21.3%. That is a narrow range, and a mean probability of 43.5% lies way outside it. As a profession, economists are clearly unusually worried.

I shall end on a (slightly) more positive note. The US is unlikely to enter recession this quarter. Of the 34 US recessions identified by the NBER since 1857, just 6 have got under way in Q4. Spending ahead of Thanksgiving, and Christmas, is probably the explanation.[3]

[1] When I published the first blog, I recorded the number of false positives over the period 1988 to 2018 as 23. Data revisions have brought that figure down to 21. By implication two countries previously thought not to have been in recession when one had been forecast now appear to have been in recession after all.

[2] For us, it was a case of getting to the right answer for the wrong reasons. Through much of 2018 we were predicting a global recession in 2020, led by the US, as we saw a period of very strong growth, with little spare capacity, ending in a Fed policy tightening.

[3] Relatedly, and for what it’s worth, February is the most troublesome month, with 5 of the 34 recessions starting then.

More by this author:

Happiness: a guide for UK policymakers