A sideways look at economics

Is it the season to be jolly yet? Everyone has their own internal clock for when it’s time to turn on the Christmas lights. This year I started thinking about Christmas way earlier than I used to, due to all the festive possibilities that a new baby brings to a household. Yes — I acknowledge that this is an excuse, because our son is too young to care about Christmas. I am striving to contain my excitement (and the expenses), but failing so far, and I am not alone in that, surely. What is surprising however is that the Scrooge-like environment that is Wall Street seems to be equally happy about Christmas; perhaps even more eager for Father Christmas to come than me. If you are into equities, you may need to pay more attention to the arrival of Santa Claus.

It is becoming a Fathom tradition to discuss in this column seasonal topics that make us feel gloomy (‘Monday blues’), equivocal (heatwaves) or cheerful (December and Christmas) through the lens of equity market reactions. Numerous theories have been mooted to explain the stock market’s seasonality. For example, bad Monday returns have been attributed to the tendency for bad news to be released and mistakes realised on Mondays, depressing sentiment among traders, as well as to the more practical reason of the end of the weekend on Wall Street driving increased selling.

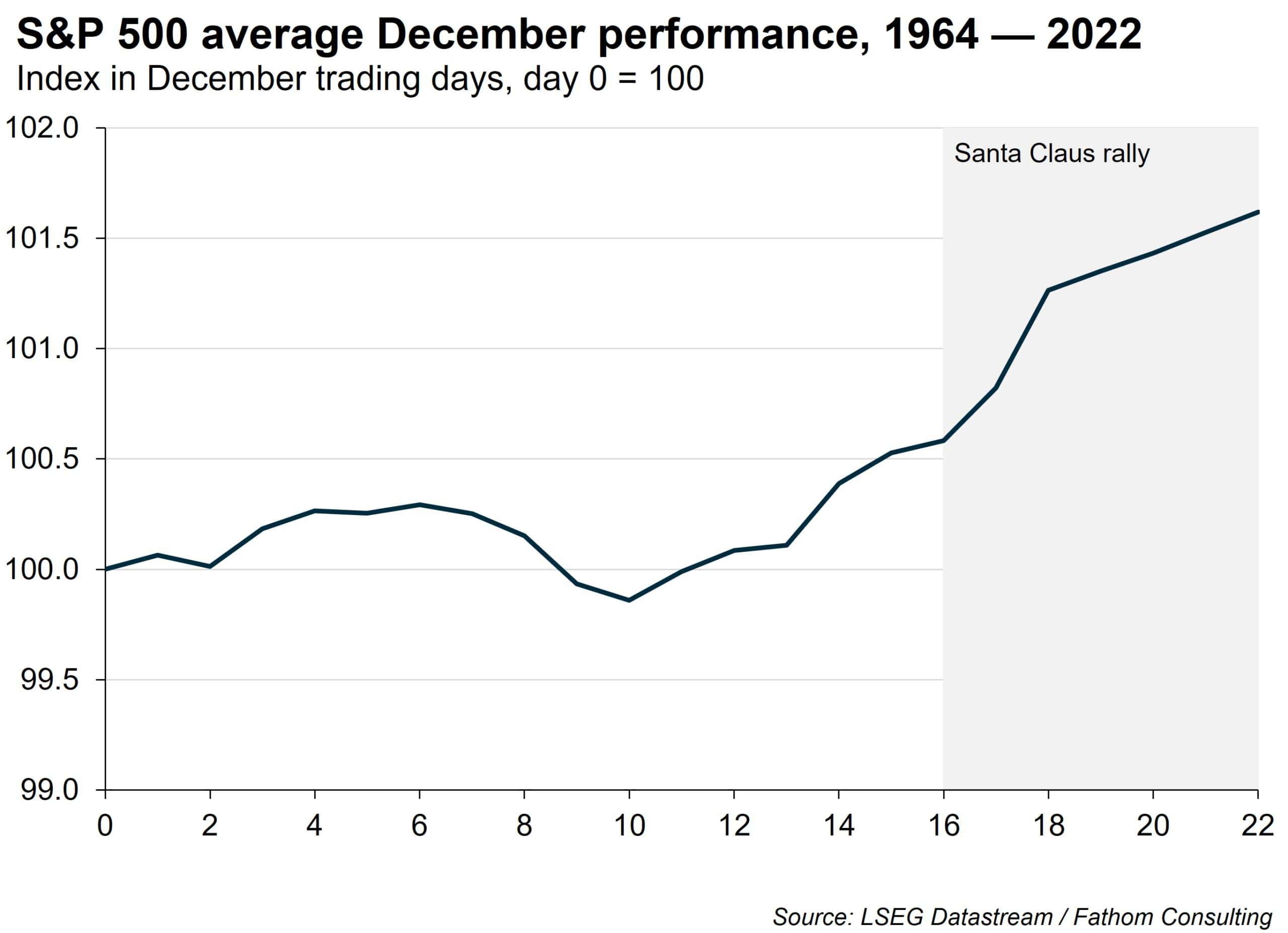

December is widely known as one of the best months of the year for stocks, but most traders don’t realise that the majority of gains happen in the latter half, after the fifteenth trading day of the month, which usually falls around the 23 or 24 December. This time of the year is widely known among equity market participants as the Santa Claus rally, because of a strong tendency for stocks to post gains during the Christmas holiday period. The term is somewhat misunderstood. Identified in 1972 by Yale Hirsch, creator of the Stock Trader’s Almanac (now run by his son Jeffrey Hirsch), the real Santa Claus rally is the seven-day trading period that starts on Christmas Eve and ends in early January, not just December. Even if you don’t believe in Father Christmas, you may consider paying the Santa Claus rally a little more attention after reading this blog.

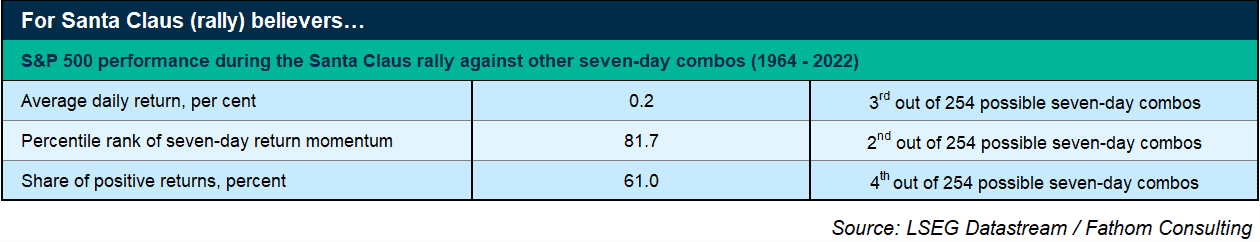

How likely are these seven trading days to be higher? Well, the cumulative return of these seven days is higher than 81.6% of all other seven-day combos of a full year — put differently, only 18.3% of other seven-day combos are better. As far as annual seven-day momentums go, the Santa Claus rally ranks second. Additionally, the average daily return of these seven-day windows stands at 0.16% (50.1% annualised), which is the third best seven-day daily average of the year. Finally, the Santa Claus rally was positive 61% of the time between 1964 and 2022, and that is the fourth best occurrence of positive returns from a seven-day combo during that period. Now do you believe in Father Christmas?

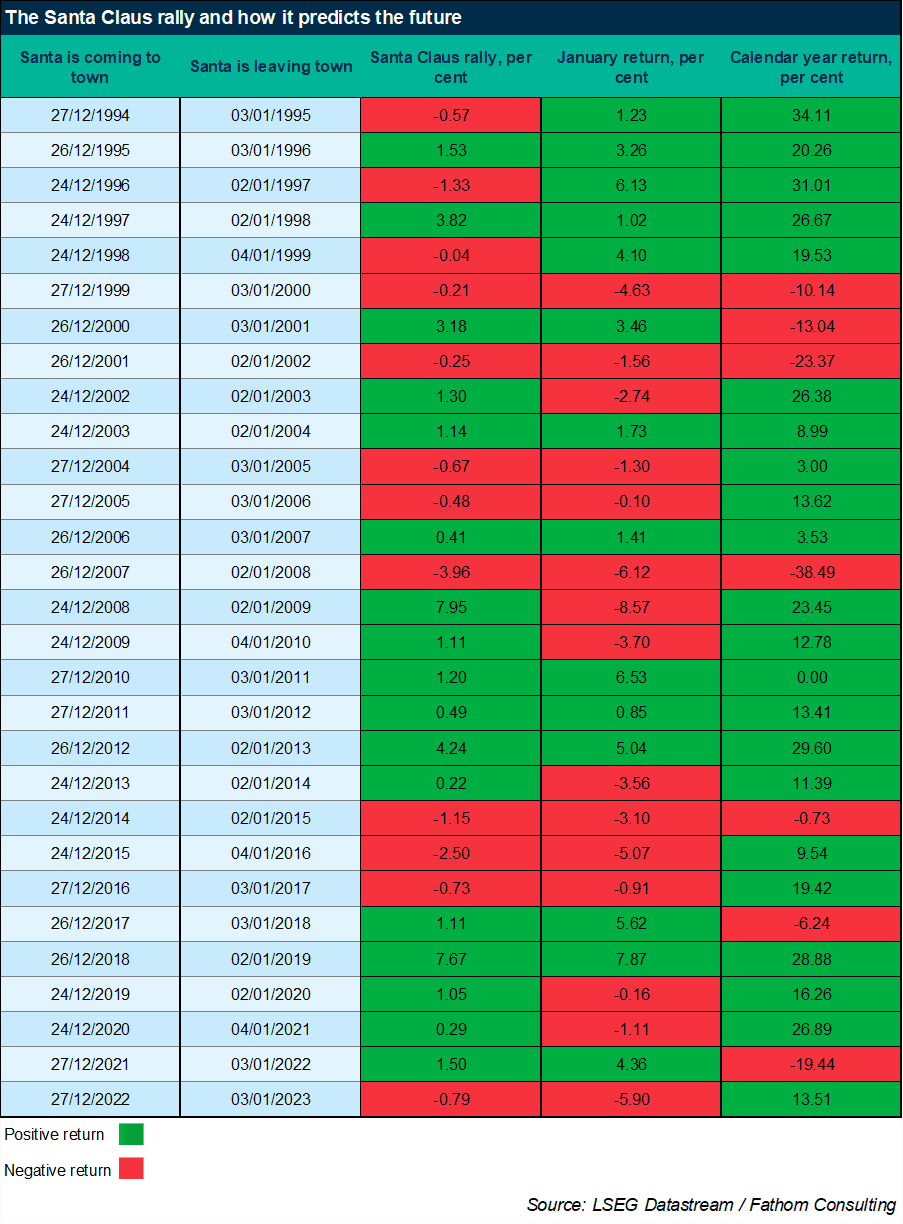

“Why are these seven days posting strong returns?” you may ask. Whether it’s optimism about the coming new year, holiday spending, traders on vacation, institutions squaring up their books before the holidays, or just the holiday spirit, the bottom line is that ‘bulls’ (investors who expect positive returns) tend to believe in Santa, or in his effect. The next table shows the Santa Claus rally’s performance since 1994. Usually these seven days are higher, which leads to strength in January. What stands out is that the times that Santa didn’t come (i.e., when there is a negative return in the first column), January was usually lower too. Going back to the mid-1990s, there have been twelve occasions when Santa’s rally failed to show up in December. January was lower on nine of those twelve occasions, and the ensuing full year posted a loss on four. The fact that the ‘bear’ markets (prolonged periods of negative returns) of 2001 and 2008 both took place after one of the relatively rare instances that Santa failed to materialise may turn you into a Santa believer after all.

The Christmas spirit runs strong in Wall Street, and whether Santa Claus is coming to town or not seems to make a difference to how the equity market starts the new year. But it won’t make a lot of difference in our house whether Father Christmas arrives in Wall Street or not. We seem to have declared open season for Santa since our son was born. That said, after putting together this analysis, I may just make a note in my calendar that the next Santa Claus rally is set to begin on Friday 22 December, and finish on Tuesday, 2 January. And, who knows? Perhaps I have got you excited enough to update your calendar too…

More by this author